Trade and taxes in Bhutan – Uncovering past and aspiring future through existing legal nuances

Trade – A brief background

Advance and growth of trade are manifestations of progress of human civilization. From horn of Africa and Levant prior 1st Millennium BC to Atlantic post renaissance via Mediterranean in the intervening years, the conduct of trade evolved by manifold. Waterways in the Nile, Tigris, the Euphrates and the Yellow River were aided by the infrastructure development in the form of road and railway which were further revolutionized by the air transport. These modes of transportations helped reach commodities of trade such as wood, silver and gold and products of information and technology to their destinations within shortest time possible. The passage from Hanseatic League[1] to the World Trade Organisation[2] (WTO) only testifies how sophisticated trade have become.

European colonial powers played significant role in expanding trade in modern sense. Rise of Portugal shifted the centre of commerce from the Mediterranean (Venice, Italy) to the South Atlantic. Enabled by their superior naval power, Portuguese through Cape of Good Hope reached the spice land of India. It also engaged in slave trade wherein slaves were brought from Sub- Saharan region in return of essential commodities such as cotton goods, firearms, beads and metal trinkets. With the rise of its Iberian neighbour, Spain, the Portuguese had to retreat. Among others, silver of the Latin America were interests to the Spaniards. The competition for overseas trade grew stiffer and thus the colony. Gradually, enabled by the innovation of the Renaissance, the fortune began to shift towards the North Atlantic. The Dutch, the French and the British rose to the power! Among them, the British, built around its naval supremacy aided by political stability and superior entrepreneurial drive among its populace established its control far and wide. Towards the end of the 19th century, British control in parts of Africa and Asia, specifically in the Sub-continent was firmly established. British not only regulated trade but also the polity.

Bhutan’s engagement in trade – A historical narrative

British interest towards the North of the Sub-continent became explicit. Series of political missions were sent to Bhutan. The British interest towards Bhutan was not singly of economic interest. Rather, the growing influence of the Soviet Union caused anxiety to British Governor Generals in British India as well as the leadership back in the United Kingdom. Therefore, she wanted to secure Tibetan markets for her growing trade and influence thereof. With Nepalese blocking the trade route from India to Tibet by the late 18th century, the entry into Tibet was only possible through Bhutan. While Bhutan shared close ties with Tibet because of religious, cultural and geographic affinity, she was aware of the aggressive imperial policy pursued by China. In addition, her engagement in trade with Cooch Behar and Kamrup[3] (Pommaret, 2013) the present day Assam acted as decisive factors in tilting her interest towards the South. Subsequently, interactions between the British India and Bhutan grew albeit punctuated by border skirmishes and Duar Wars.

Building on the legacies of the British India times, Bhutan and India continued the mutual relationship in the areas of trade, culture and security. Growth in trade in particular is significant. From Rs.271 thousand in 1899-1900 to Rs.1.27 million in 1905-06 (Ray and Sarkar, 2013), to Nu.85,541.85 million by 2015 (Ministry of Economic Affairs, 2016), the growth is tremendous.

This growth is attributed to policy initiatives accorded by the two countries. In 2006, Bhutan and India signed an agreement on trade, commerce and transit between the two countries. Article 1 of the Agreement states, “There shall, as heretofore, be free trade and commerce between the territories of the Royal Government of Bhutan and the Government of the Republic of India” (Royal Government of Bhutan, 2006). This provision is not the first of its kind between the two countries. Indeed, Article IX of the Treaty of Sinchula concluded between the Bhutan and British India called for abolition of duty on goods traded between Bhutan and India. However, Bhutan’s reluctance to engage in unrestricted trade did not come anything good from the particular clause (Ray and Sarkar, 2013).

The current trend – Exploring legal nuances

Enabled by the trade agreement of 2006 vis-a-vis long established trend of people to people contact propelled by rather porous border, the trade between the two countries grew. Further, as the globalisation gained momentum, Bhutan began to engage in trade with the rest of the world. Realizing the need to regulate the fast growing trade, laws, particularly the Sales Tax, Customs and Excise Act of the Kingdom of Bhutan 2000 was enacted. The Act intends to, “…Ensure economic progress, promote social justice, general welfare…” Further, securing financial sustainability through fair levy and collection of taxes and duties is one of the overarching objectives (The National Assembly of Bhutan, 2000). On that premise, Sales Tax for imports is enacted as one of the legal instruments for the State to earn minimum to invest in further growth and prosperity. The Sales Tax, Customs and Excise (Amendment) Act of Bhutan 2012, Part I, Sales Tax, Chapter 1, section 1 (ka), specifies persons importing goods and services into Bhutan to declare the import for taxes as provided under Part I, Sales Tax, Chapter 2, section 2 of the same Act, “A person or government institution within the Kingdom of Bhutan” (The Parliament of Bhutan, 2012).

However, it is only the business firms that declare goods imported from India[4]. Hundreds[5] of Bhutanese walk across the border from Phuntsholing to Jaigaon every day with majority returning with the items worth not less than Nu.1,000.00 on an average. Considering at least 500 Bhutanese buy goods worth Nu.1,000.00 from Jaigaon every day, import amounting to Nu.182 million would have been made in a year. Individuals do not declare imported goods let alone paying sales tax stating that it is for the ‘household consumption’ and business firms declare because it is for sale. The act requires ‘persons importing goods and services to pay sales tax’. The Sales Tax, Customs and Excise Act of the Kingdom of Bhutan 2000 defines persons as, “…Any individual, entity, company, body corporate or any other organisation, institution or group of persons having a status under this Act” (The National Assembly of Bhutan, 2000). Individual importing goods does have status. Is Sales Tax applicable for the goods imported for household consumption then? The same Act defines Sales Tax as “a consumption tax levied on goods and services” (The National Assembly of Bhutan, 2000). Sales Tax is not the tax for sale but for the consumption!

Can an individual invoke the free trade clause of the Bhutan-India Trade agreement? A business firm would pursue the same. Free trade can be better understood in relation to the Sales Tax and Duty levied for imports. Duty is different from Sales Tax in the sense Customs Duty as defined in the Sales Tax, Customs and Excise Act 2000 is the duty for import and export. In that light, free trade can be interpreted as flow of goods and services from one country to another without having to pay charges on crossing the international border not necessarily exempting the consumption taxes which is either paid directly by the individual or through the business entity from whom an individual buys once it is imported.

If an individual need not have to pay Sales Tax for their imports, the Free Baggage Allowance granted under Sales Tax, Customs and Excise Rules 2001 has no purpose. The Point 10.1.2 of the Rules allows Bhutanese passport holders and any other national working as a regular employee in Bhutan and resident in the country arriving with a baggage to bring in personal items up to the assessed value of US$1,000.00 or equivalent in Ngultrum without payment of duties and taxes (Ministry of Finance, 2001). Duties and taxes are different instruments of taxes, thus cannot be treated as synonym. It can be inferred that Sales Tax for imports made by an individual for household consumption if exempted can only be exempted for items worth not more than US$ 1,000.00 or equivalent upon fulfilling the above conditions.

The issue transcends tax revenue lost to the State. Going by the earlier projection, Nu.182 million worth of import would go unreported from Phuntsholing alone. Inferring from the freight traffic crossing of 73 per cent of annual exports and 83 per cent of annual imports from Phuentsholing (Ministry of Economic Affairs, 2012), Bhutanese individuals buying from across the border and not declaring the import would be minimal from other border areas, specifically, Samdrup Jongkhar and Gelephu. That said, small consignments make the aggregate.

The overall trade for the year 2015 was Nu.103,266.63m with import accounting of Nu.68,037.32m and export Nu.35,229.31m giving rise to negative balance of trade of Nu.32,808.01m. Among others, trade with India constitute a major share with trade amounting to Nu.85,541.85m with import amounting to Nu.53,740.50m and export Nu.31,801.35m accounting to trade deficit of Nu.21,939.15m (Ministry of Economic Affairs, 2016). Considering significant share of unreported import, specifically garments and textile from Jaigaon, the government of the day fed by the reported trade statistics is made to belief that cottage industries is thriving in the country since there is no official indication that sheer volume of goods have been imported. Inadvertently, this diverts attention of the government to intervene in key cottage industries such as hand loom where not only employment but also the culture passed down the generations are at stake.

Can this phenomenon be understood in the light of informal trade? Informal trade is a global issue constituting a significant share of Country’s Gross Domestic Product (GDP). In 2003, Africa is reported to have 43% of GDP engage in informal sector, Latin America 43%, Central and Eastern Europe 40%, Asia 30% and Organisation of Economic Cooperation and Development (OECD) countries 16.3% (Moise-Leemen and Lesser, 2009). This concludes that informal trade is more common in developing economies and Bhutan is not an exception. Informal trade constitute three broad features:

- Unregistered traders,

- Formal businesses fully evading taxes and

- Formal businesses partially evading taxes (Mossie-Leemen and Lesser, 2009).

Fueled by price disparities, complex, non-transparent and divergent regulations and weak law enforcement at the borders, fraudsters avoid official border posts, pass through illegal practices such as under-invoicing, misclassification and mis-declaration of country of origin and facilitation payments in the form of bribe to the enforcers. The implications are adverse. It promotes unfair competition, reduces incentives to invest in formal sector, erodes government revenues and sanitary and phyto-sanitary controls. The preceding enumeration of informal trade does not explain the phenomenon of individuals buying goods from across the border. This presents a unique case to be explored of what can be done, at least to integrate it into the policy formulation of the State.

Is the concept of informal trade irrelevant in Bhutan then? As Bhutan continues to grow and private sector still in its nascent stage, small and medium scale businesses are common. Further, trade by potter and ponies continue between remote parts of Bhutan in Trashigang with Tawang (India) and Haa with China, however, most of the transactions go unaccounted (Ministry of Economic Affairs, 2014). Bisht (2012) also reported that informal trade across Bhutan-India border towns such as under-invoicing to evade tax is still common. These unreported imports both by individual and small businesses will have policy implications at national level, particularly in the areas of agriculture as in the case of Niger, Cameroon and Benin where informal cross-border inflows of agricultural commodities undermined the longer-term viability of local formal agriculture, by under-cutting commodity prices (Meagher, 2003 as cited in Moise-Leeman and Lesser, 2009).

Loss of revenue to the State deserves special mention for Bhutan’s capital expenditures are largely funded through external grants and borrowings. “In Uganda, for example, the tax revenue loss arising from the estimated informal imports from its five neighbouring countries during the 10 monitored months in 2004/5 is estimated at US$10.1 million, representing approximately 3% of Uganda’s total customs revenues excluding oil in 2004.” (Republic of Uganda, 2007 as cited in Moise-Leeman and Lesser, 2009). Similar case has been reported by the Royal Monetary Authority (RMA) wherein informal trade[6] is valued at Nu.2 billion ($45 million) per year making up to 7 per cent of official goods exported. The findings indicate that duty losses are likely to be minimal considering the duty-free trade agreement with India, and excise tax levied only on domestic alcohol. However, sales tax is avoided. And food taxed at 5 to 20 per cent, it is projected that several million dollars of revenue are lost (Ministry of Economic Affairs, 2012). The Royal Audit Authority (RAA) also reported that growing informal businesses are not under the scope of tax (Dorji, 2016).

Recommendations-Bhutan we aspire

Informal trade is detrimental both from policy front as well as in revenue terms. In that light, studies have found list of viable options to tackle the issue.

- Improving trading opportunities in formal sector: Simplified tax regime and documentation formalities aided with expeditious release and clearance from customs custody is expected to reduce disproportionate compliance burden. However, lower levels of literacy, particularly among small businesses may pose challenges in information dissemination.

- Honest, aggressive and accountable law enforcement at the border: Vertically organized systems of collective bribery and shared payments among inspectors (Johnson, n.d.) and Customs Officials ignoring informal trade such as the case of import of food stuff in Ethiopia (Little, 2007) are disastrous. Infusing ethical values coupled with reasonable salary and skills development through training is expected to curb the menace.

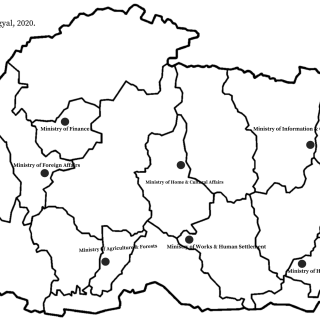

- Cooperation and Coordination among border agencies: From people to commodities ranging from food, plants, garments and pharmaceutical products, the border sees entry of several products under varying jurisdiction. In Bhutan, at least nine different agencies are involved in issuing clearance for imports: Ministry of Agriculture and Forests for chemicals and fertilizers; Ministry of Agriculture and Forests/BAFRA for live animals and their products, plants and plant materials; Royal Bhutan Army for arms and ammunition; Ministry of Home Affairs for explosives and explosive devices; Ministry of Health for drugs and pharmaceutical products; National Environment Commission (NEC) for industrial and toxic waste and residues, and scraps; RMA for gold and silver in excess of free allowance; Bhutan InfoCom & Media Authority (BICMA) for wireless and remote-sensing telecommunication and broadcasting equipment; and MoEA for used or second-hand goods, machinery, plastic packing materials, goods for which there is no market within the country. The report acknowledges that in absence of a comprehensive set of import and export regulations, the current legal framework consisting of pieces of subsidiary legislation, such as notifications and regulations issued by various agencies, lacks central control and creates legal uncertainty (Ministry of Economic Affairs, 2012). Enacting central legislation and collaboration such as setting a physical Single Window like that of Douala Port, Cameroon linking together various agencies’ will enable speedy information sharing and data transmission amongst the border agencies.

- Streamline the role of brokerage system in the transaction: Middleman in trade, both Clearing Agents and brokers are very much part of Bhutan’s trading practices. While it helps the business complete their task by skilled people, brokers by helping prepare documents and/or electronic submissions; calculate and pay taxes and duties on clients behalf, and facilitate communication between the traders and governmental authorities will incite firms to trade informally through facilitation payments whereby State’s treasury is least taken care of. The World Bank Customs Modernisation Handbook finds customs brokers as conduits through which-facilitation payments are demanded and paid, and added to the brokerage fees. Such menace will only be curbed by enacting strong laws streamlining the roles of the brokers vis-a-vis the businesses themselves.

- Information Sharing: Levin and Widell, 2007 (as cited in Mosie-Leeman and Lessser, 2009) espoused that customs data with the trading partner be compared so as to determine the informal trade. However, it will be tough for a developing country like Bhutan. In the first place, pursuing diplomatic channels will be lengthy. Secondly, India with whom Bhutan’s trade constitute most is, unfortunately, not well received in anti-corruption efforts. Kaushik Basu, the chief economist of the World Bank and former chief economic adviser to the Indian government, is quoted as saying, “…The nation’s tradition of petty corruption helped India avoid the worst of the banking crisis that has crippled most other large economies in the last few years.” He went onto say that “economics is not a moral subject.” An informal trade is best exemplified wherein ‘sellers would accept only 50 rupees as a formal payment and demand the rest in cash’. In that vein, he proposes, “…the way to rooting out corruption-legalising bribery” (Rowlatt, 2016). This assertion from one of the esteemed economist only confirms how difficult is to get a true record of transactions. Against this backdrop, building network of information sharing with trading partners as well as inculcating values of ethical business is crucial, however difficult may it be.

- Awareness on individuals’ liability to declare goods imported from household consumption: The general assumption among Bhutanese is that goods bought from India for household consumption is exempt from sales tax. Let alone those general public, observations have indicated that literate Bhutanese who claim to serve Tsa-Wa-Sum do buy goods from Jaigaon but do not declare it stating it is for household consumption. Building on the arguments of this paper, concerned agencies such as Department of Revenue and Customs, and its regional offices, the custodian of Sales Tax, Customs and Excise Act of Bhutan and rules thereof need to create awareness on the subject. Further, individuals at our levels can also share the same among one’s circles. This would not only help earn revenue for the State but also generate true import figures. Subsequently, Bhutanese could be persuaded to buy from Bhutan whose goods are expected to have been declared thus helping Bhutanese businesses[7] to grow.

[1] An alliance of German merchants between 12th to 17th centuries formed to enhance flow of trade and ensure protection against pirates.

[2] An International Organisation that promotes free trade among participating countries.

[3] Bhutan exported horses and musk in exchange of cloth, tools, spices and tobacco. Particularly from Assam, Bhutan bought areca nut and Betel.

[4] The assertion is solely based on the observation of entry of Indian goods from Jaigaon to Phuntsholing, Bhutan.

[5] The Bhutanese Security at pedestrian entry to Jaigaon from Bhutan puts the approximate figure of not less than 1,000 Bhutanese entering Jaigaon in a day.

[6] In absence or rather inability to find the clear definition of the informal trade in Bhutanese context, it is treated in line with the three broad features elucidated in the paper.

[7] The perspective does not conclude that all businesses in Bhutan are operated by Bhutanese. At least, goods bought from Bhutan, Phuntsholing for the purpose of this perspectuve, are said to have declared and taxes paid thereof.

[Disclaimer: The views expressed here are of my own. Written in June 2016 at Phuntsholing].